The Mayor and Councillors are entitled to receive an allowance while performing their duty as an elected official, with the Victorian Government responsible for setting the upper and lower levels of these allowances.

The Mayor, Deputy Mayor and Councillors are entitled to receive from the Council an allowance as determined by the Victorian Independent Remuneration Tribunal. Effective from 1 July, 2025 the Victorian Independent Remuneration Tribunal has determined that the allowance payable to Mayors, Deputy Mayors and Councillors (Victoria), for a category 2 Council are as follows: Mayor $115,347 Deputy Mayor $57,673 and Councillors $35,049. The allowance is inclusive of any Superannuation Guarantee Contribution amount, or equivalent, that may be payable under Commonwealth law to the Council member with respect to their service. For further information please see www.remunerationtribunal.vic.gov.au/allowances-mayors-deputy-mayors-and-councillors.

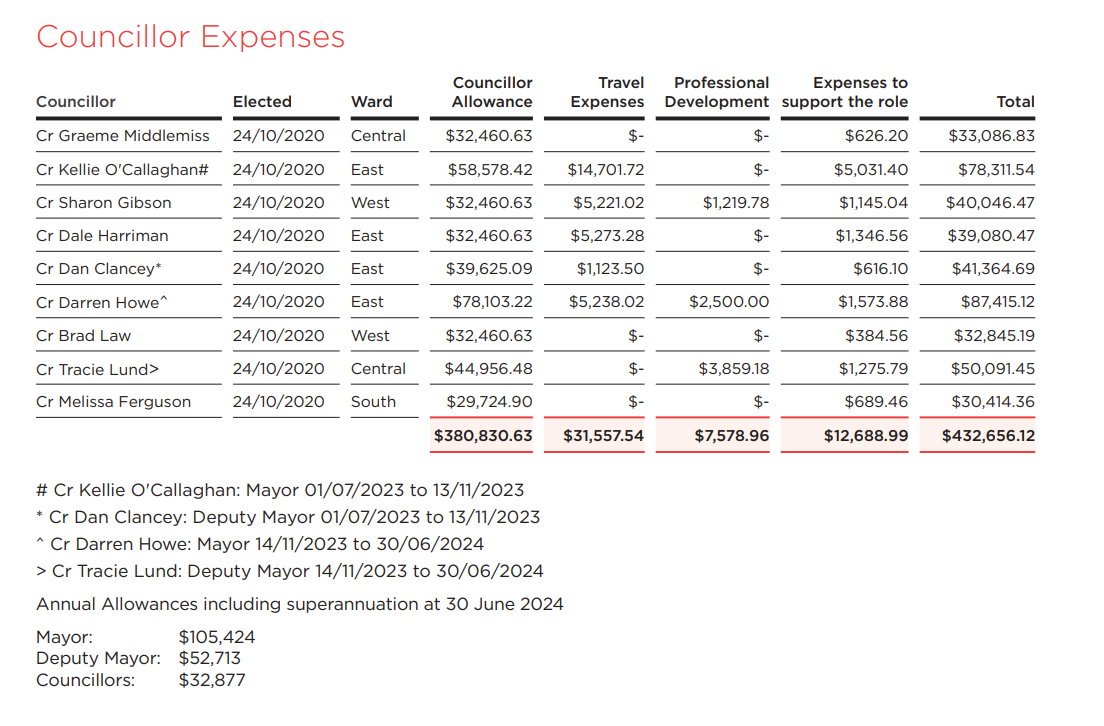

In addition to the Mayor and Councillor allowances, Councillors are also provided with a number of resources and support to assist them in undertaking their duties. This includes office administration and support, professional development support, and equipment such as mobile phones, computers, tablets and printers. Councillors are also entitled to seek reimbursement for expenses such as travel and childcare.

The Mayor also receives use of a fully maintained motor vehicle, a dedicated office, and support from an assistant. These expenses and resources are specified in the Councillors and Delegated Committee Members Expenses, Resources and Support policy, a copy of which is available from the Latrobe City Council website.